TCFD Disclosure

1. Governance

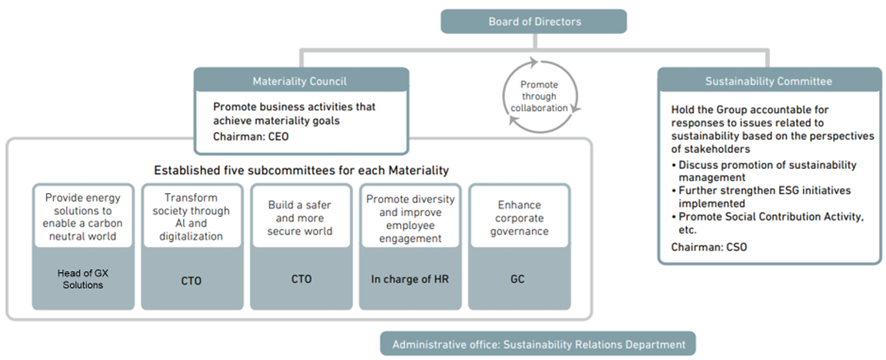

MHI Group has identified the "provision of energy solutions to enable a carbon-neutral world" as a material issue under our materiality framework ("materiality"), which responds to the important global issue of climate change. Our materiality initiatives help us to realize sustainability management throughout our business operations. Through this approach to materiality, we aim to increase our corporate value and drive medium- and long-term growth. The Materiality Council, chaired by the MHI Group CEO, meets twice a year to confirm the status of business activities to achieve the materiality targets, discuss the direction of future initiatives, and instruct business divisions to take necessary measures.

The Sustainability Committee, chaired by the MHI Group Chief Strategy Officer (CSO), meets twice a year to ascertain, from the perspective of stakeholders, the responsibilities that MHI Group should meet in terms of its response to increasingly dense sustainability issues, and considers the promotion of sustainability management. In addition, the committee deliberates and decides on basic policies and other matters related to ESG initiatives, and promotes related activities.

The CSO is responsible for assessing and managing climate-related risks and opportunities and reporting within the Sustainability Committee. The CSO also reports to the Board of Directors at least once a year on the status of the Sustainability Committee's activities, including the assessment and management of climate-related risks and opportunities.

In addition, since FY2023, evaluation results by major ESG evaluation organizations, including the assessment of the Company's response to climate change, have been reflected in the stock-based remuneration portion of officer remuneration.

Sustainability Promotion System

2. Risk Management

The process of identifying, assessing, and managing climate-related risks and opportunities is integrated into the overall sustainability promotion system of the Group. Specifically, under the responsibility of the CSO, we identify, assess, and manage climate-related risks and opportunities through the following four steps:

| Step 1 | Referring to external scenarios, the administrative office identifies and assesses risks and opportunities for each business unit. |

| Step 2 | The risks and opportunities identified in Step 1 are assessed against the current business plans of each unit to ensure alignment. |

| Step 3 | During the planning stages of actual projects, risk management is thoroughly conducted through review meetings and others within each business unit. |

| Step 4 | The risks and opportunities identified and assessed by the administrative office and each business unit are presented to the higher-level organization, the Sustainability Committee, which reviews and manages them. |

3. Strategies (Scenario Analysis)

(1) Assumptions for Scenario Analysis

■ Climate-related scenarios

MHI Group has developed two climate change scenarios and assessed climate-related risks and opportunities.

The first scenario is the "scenario in which decarbonization is advanced worldwide through stricter climate change policies (Decarbonization Scenario)," which aims to achieve economic growth while limiting the global average temperature rise to a maximum of 1.5℃ above pre-industrial levels in the year 2100. This scenario depicts a world in which strict measures are implemented to reduce greenhouse gas emissions, and society as a whole works to address climate change. The scenario parameters are based on data disclosed by international organizations and the Japanese government (see Note 1).

- 1IEA Net Zero by 2050 - A Roadmap for the Global Energy Sector, IPCC Sixth Assessment Report, Climate Impacts of an SSP1-1.9 Scenario, and information disclosed by the Ministry of the Environment and Japan Meteorological Agency.

The other scenario is the "scenario in which climate change policies are not made stricter and the world's dependence on fossil fuels continues (Fossil Fuel Dependency Scenario)," which assumes a global average temperature increase of 4.0℃ above pre-industrial levels in the year 2100. This scenario assumes a world where stricter measures to reduce greenhouse gas emissions are failed to be implemented, and natural disasters become more severe and frequent over time. The scenario parameters are based on data disclosed by international organizations and the Japanese government (see Note 2).

- 2 IPCC Sixth Assessment Report, Climate Impacts of an SSP5-8.5 Scenario, and information disclosed by the Ministry of the Environment and Japan Meteorological Agency.

■ Definition of short-, medium-, and long-term time horizons

For the analysis, "short-term," "medium-term" and "long-term" time horizons are defined and considered as follows.

Definitions of time horizons considered

| Time horizon | Period | Reason for setting |

| Short-term | Over the next three years, from FY2024 to FY2026 | Established in line with the period of MHI Group's 2024 Medium-Term Business Plan |

| Medium-term | Through 2030 | Established in line with the interim target year of MISSION NET ZERO, MHI Group's Declaration to Achieve Carbon Neutrality |

| Long-term | Up to 2040 | Established in line with the Net Zero target year of MISSION NET ZERO, MHI Group's Declaration to Achieve Carbon Neutrality |

■ Degrees of potential financial impacts

In the analysis of the potential financial impact, the impact on business profits was assessed based on the following criteria.

Degrees of Impact

| Impact | Definition |

| Large | 10 billion yen or more |

| Medium | 5 billion yen to less than 10 billion yen |

| Small | Less than 5 billion yen |

(2) Shared Risks and Opportunities for the Group under the Climate-related Scenarios

■ Shared risks and opportunities for the Group under the Decarbonization Scenario

In addition to physical risks such as increasing natural disasters, as a shared transition risk for the Group, the Decarbonization Scenario assumes a significant rise in the cost of carbon emissions due to an increase in regulations such as carbon taxes. On the other hand, as demand for product and services that contribute to decarbonization is expected to increase towards achieving a carbon neutral world, expanding business opportunities are anticipated through providing corresponding products and services.

■ Shared risks and opportunities for the Group under the Fossil Fuel Dependency Scenario

The Fossil Fuel Dependency Scenario focuses on the physical risks associated with climate change. In terms of opportunities, as it is difficult to imagine that future regulations will be eased in developed countries that are already promoting various environmental regulations, we consider that there are ample business opportunities through offering products and services that contribute to decarbonization.

(3) Potential Financial Impacts of and Responses to Shared Risks and Opportunities for the Group

■ Shared transition risks for the Group under the Decarbonization Scenario: Potential financial impacts of and responses to regulatory strengthening such as carbon taxes (Medium to long term)

We believe that, given the global situation regarding carbon taxes and other carbon pricing policies, the economic burden in developed countries such as Japan will increase.

If we apply the carbon price projections from the IEA's Net Zero Emissions by 2050 (see Note 3) to the Scope 1 and 2 future projections for CO2 emissions reduction at Group sites, supposing that we do not implement measures to reduce CO2 emissions such as energy conservation, streamlining, electrification, and decarbonized fuel conversions, and estimate the potential financial impact, we rate the degree of impact as "Large."

- 3140 USD/t-CO2 in 2030 and 205 USD/t-CO2 in 2040 in advanced economies with net zero emissions pledges.

To reduce this impact, MHI Group will promote energy conservation, the introduction of carbon-free power sources, and the carbon neutralization of all plants based on our own technologies. For example, we are considering incorporating high-temperature heat pumps and hydrogen power generation equipment into our own manufacturing facilities. MHI Group has already positioned its plant in Mihara City, Hiroshima Prefecture, as a pilot plant for achieving carbon neutrality and has installed solar power generation equipment.

By leveraging the knowledge and new technologies gained from this initiative, we will also work to develop new business opportunities by allowing customers to visit and see actual emission reduction technologies in operation at the plant as a model case.

■ Shared physical risks for the Group under the Decarbonization and Fossil Fuel Dependency Scenarios: Potential financial impacts of and responses to increasing natural disasters (Long term)

Physical risks from natural disasters (wind and water damage, etc.) are assumed in the Decarbonization and Fossil Fuel Dependency Scenarios. We recognize the risk of increasing natural disasters potentially causing property damage to our Group's facilities and supply chain disruptions due to damage to our partners' facilities.

We have determined that among our Group, which is expanding globally, we are most vulnerable to natural disasters in Japan where roughly 90% of disasters that have impacted our Group have occurred in the last seven years. These have been primarily due to typhoons, high tides, and torrential rain. Taking water-related disasters as an example, we estimated the potential future financial impact using the Group's past property damage records, and the parameters for the frequency of floods from 2040 published by the Ministry of Land, Infrastructure, Transport and Tourism (see Note 4). As a result, we have rated the impact as "Small" under the Decarbonization Scenario, and "Medium" under the Fossil Fuel Dependency Scenario.

- 4Based on "Recommendations for Flood Control Plans in Consideration of Climate Change" from MLIT's Technical Review Committee on Flood Control Plans in Consideration of Climate Change, approximately 2 times under the 2℃ scenario (read as the Decarbonization Scenario in this analysis), and 4 times under the 4℃ scenario (read as the Fossil Fuel Dependency Scenario).

To prepare against disaster damage, we review our procedures on a regular basis, which specify alternative measures and backup systems in the event of a disaster causing catastrophic functional failure within our businesses, and we conduct extensive training for employees and other relevant personnel. Furthermore, we have been taking measures based on the results of the risk survey conducted in all domestic plants up to FY2021 to reduce the risk of property damage in the event of a disaster, on the assumption that the frequent occurrence of major disasters could result in higher insurance premiums or suspension of insurance coverage in high-risk areas.

■ Shared business opportunities for the Group under the Decarbonization and Fossil Fuel Dependency Scenarios: Potential financial impacts of and responses to expanding demand for products and services that contribute to decarbonization (Medium term)

Under the Decarbonization Scenario, implementation in society of products and services that contribute to decarbonization will be essential. Further, under the Fossil Fuel Dependency Scenario, we anticipate increasing demand for products and services that contribute to decarbonization, especially in developed countries that are already proceeding with various environmental regulations.

MHI Group has included "Commercialize Future Growth Areas" as a focus area in its 2024 Medium-Term Business Plan, and is strongly promoting "Energy Transition," which aims to decarbonize the energy supply side, and "Smart Infrastructure," which aims to enable energy conservation, automation, and decarbonization on the energy demand side. In these areas, we aim to reach a business scale of 1 trillion yen by fiscal 2030.

(4) Risks and Opportunities for Major Businesses under the Decarbonization Scenario (Detailed Analysis)

MHI Group is engaged in a wide range of businesses, and since the risks and opportunities differ depending on the individual business, we conduct a separate analysis for each business of the risks and opportunities expected in the medium term when the Decarbonization Scenario is applied to all businesses. Of these, detailed analyses were conducted for the major businesses.

The following criteria were used to select which businesses to analyze in detail:

- Businesses at or above a certain scale (roughly 200 billion yen) that are significantly impacted by carbon neutrality

- Businesses that are currently small in scale but are expected to grow significantly in the future due to the impact of carbon neutrality

■ Risks for major businesses under the Decarbonization Scenario (Transition risks)

- As a result of the global shift to electrification, we can expect reduced demand for turbochargers for automobiles and engine-powered forklifts, and we can also expect the shift to carbon-neutral fuels to reduce demand for diesel-fueled engines.

- Anticipated technology-related risks include delays in the development of our new products such as hydrogen gas turbines, and the emergence of alternative technologies for CO2 capture equipment.

- As a risk related to changes in government policy, there is a possibility that environmental regulations, such as those applying to refrigerants, will be excessively strengthened, resulting in lost sales opportunities for existing HVAC products that do not comply with the regulations.

- Anticipated impacts from the external environment include delays in the establishment of supply chains for hydrogen and ammonia as cleaner energy sources to replace or supplement fossil fuels, and consequently, delays in the launch of new markets.

■ Opportunities for major businesses under the Decarbonization Scenario

- As the trend toward carbon neutrality progresses around the world, including in emerging countries, fuel conversion from coal is expected during the transition period. In the Japanese market, boosted by government policies such as the "Long-Term Decarbonization Power Source Auction," demand is expected to increase for retrofit work to convert coal-fired power generation facilities to ammonia, as well as for high-efficiency gas turbine combined cycle power plants (GTCCs), and hydrogen-fired gas turbines.

- In engines, demand is expected to increase for gas engines in line with fuel conversion from diesel to natural gas, as well as for engines that use carbon-neutral fuels such as biodiesel.

- In an effort to realize both carbon neutrality and a stable energy supply, Japan's Cabinet approved the Seventh Strategic Energy Plan indicating the direction for energy policy. In addition to renewable energy, the plan expresses a policy of maximizing the use of nuclear power. In light of this strategy, we expect an expansion of business opportunities related to the restarting of existing PWR and BWR plants, the establishment of Specialized Security Facilities to deal with major accidents, and the maintenance of plants that have already been restarted. Business opportunities are also expected to expand with, for example, potential for new construction and replacement projects based on our advanced light water reactor (SRZ-1200), which will provide the world's highest standards of safety. In addition, we will promote conceptual and basic designs with the aim of demonstrated operation for high temperature gas-cooled reactors and fast reactors.

- In CO2 capture and storage, market growth is expected in North America and Europe in particular, where legislation, tax systems, and CO2 storage sites are being developed, though other regions are also expected to grow as frameworks are put in place and CO2 storage sites developed. MHI has a wide range of products for CO2 capture, from large to small and medium-sized, and is one of the few manufacturers in the world with both CO2 capture technology and GTCC, allowing us to provide solutions that meet the needs of many customers. In addition to expansion in the application of CO2 capture technologies to various industries and a broader service menu, we anticipate increased business opportunities throughout the CCUS value chain, including CO2 transport, CO2 storage, and carbon recycling.

- In metals machinery, the switch from blast furnaces is expected to boost demand for electric arc furnaces (EAFs) and direct reduction equipment.

- In logistics systems, demand for battery forklifts is expected to increase with the global shift to electrification. Demand is also expected for environmentally friendly port cargo handling equipment (RTGs) is expected.

- In HVAC systems, the tightening of environmental regulations such as those for refrigerants is expected to drive sales of air conditioners that use refrigerants with lower global warming potential and heat pump heaters.

- In the hydrogen-related business, in addition to increased demand for products related to the use of hydrogen, such as hydrogen gas turbines, hydrogen engines, hydrogen reduction ironmaking equipment, and electric compressors for fuel cells, expanded business opportunities are expected throughout the hydrogen value chain, including hydrogen production, transport, and storage.

- Other efforts include working to establish new businesses in preparation for global carbon neutrality. Specifically, we have invested in an offshore wind power generation company in Hokkaido, and are working to develop the manufacturing technologies for Sustainable Aviation Fuel (SAF).

- The acceleration of digitalization worldwide is driving expansion of the market for new data centers, and we anticipate growth in our data center-related business. We will continue to provide products and services that realize stable operation while meeting needs for decarbonization.

(5) Potential Financial Impacts of and Responses to Risks and Opportunities by Business Domain

In terms of potential financial impacts of the above risks and opportunities, we predicted and estimated the difference in business profit at the time of formulation of the Medium-Term Business Plan and 2030, by business domain.

■ Potential financial impacts of and responses to risks and opportunities by business domain under the Decarbonization Scenario (Medium term)

Risks

Energy Systems

| Type | Content | Impact | Response | |

| GTCC | Technology |

|

Small |

|

| Steam Power | - |

|

- | - |

| Nuclear Power | - |

|

- | - |

Plants and Infrastructure Systems

| Type | Content | Impact | Response | |

| CO2 Capture System | Technology |

|

Small |

|

| Metals Machinery | - |

|

- | - |

Logistics, Thermal & Drive Systems

| Type | Content | Impact | Response | |

| Engines and Turbochargers |

Market/Customer Trends |

|

Small |

|

| Logistics Systems | Market/Customer Trends |

|

Small |

|

| HVAC Systems | Changes in Policy and Legislation; Market/Customer Trends |

|

Small |

|

Data Center & Energy Management

| Type | Content | Impact | Response | |

| Data Centers | - | - | - | - |

- In determining the impact of risks and opportunities, we compared the impact on business profit at the time of formulation of the Medium-Term Business Plan and 2030. Based on this, the risks associated with declining demand for coal-fired power plants and carbon-intensive steelmaking plants have been factored into the base plan figures.

Opportunities

Energy Systems

| Type | Content | Impact | Measures | |

| GTCC | Changes in Policy and Legislation; Market/Customer Trends |

|

Medium |

|

| Steam Power | Changes in Policy and Legislation; Market/Customer Trends |

|

Medium |

|

| Nuclear power | Changes in Policy and Legislation; Market/Customer Trends |

|

Large |

|

Plants and Infrastructure Systems

| Type | Content | Impact | Measures | |

| CO2 Capture System | Changes in Policy and Legislation; Market/Customer Trends |

|

Large |

|

| Metals Machinery | Market/Customer Trends |

|

Small |

|

Logistics, Thermal & Drive Systems

| Type | Content | Impact | Measures | |

| Engines and Turbochargers |

Market/Customer Trends |

|

Small |

|

| Logistics systems | Market/Customer Trends |

|

Small |

|

| HVAC Systems | Changes in Policy and Legislation; Market/Customer Trends |

|

Small |

|

Data Center & Energy Management

| Type | Content | Impact | Measures | |

| Data Centers | Market/ Customer Trends |

|

Large |

|

4. Metrics and Targets

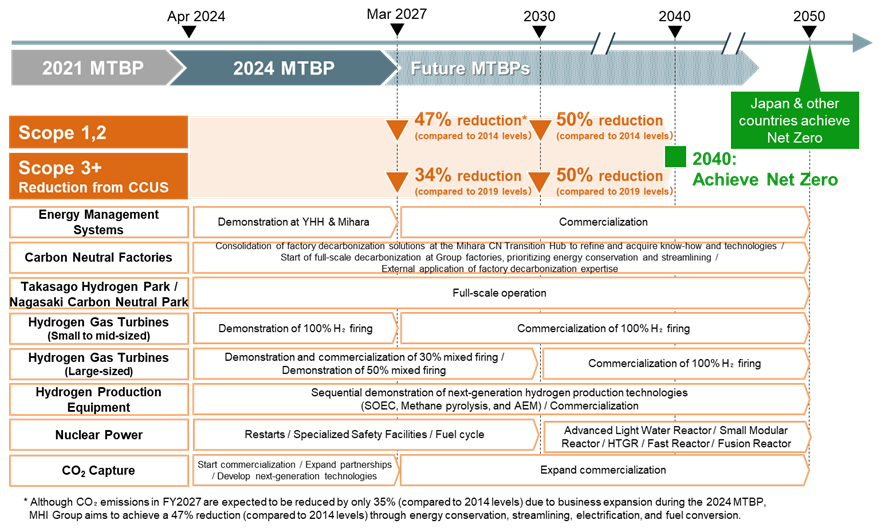

(1) Declaration of Achieving Carbon Neutrality by 2040

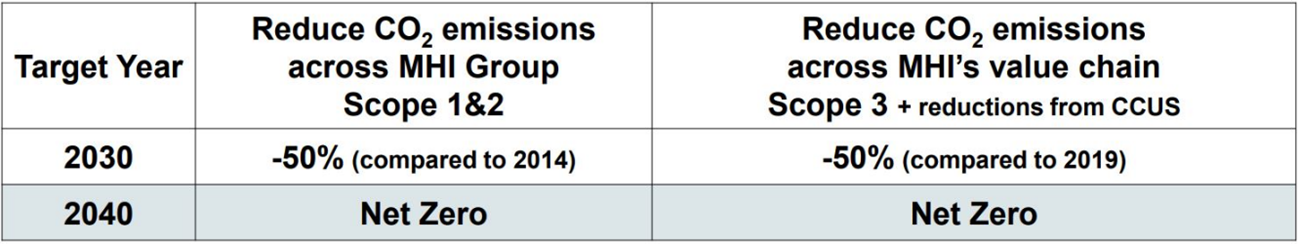

MHI Group has identified the "provision of energy solutions to enable a carbon-neutral world" as a material issue and has announced MISSION NET ZERO, our commitment to achieving Carbon Neutrality by 2040, which includes two targets.

The first target is to reduce the CO2 emissions from production activities at the Group's facilities (Scope 1,2 (see Note 5)) to net zero by 2040. As an interim target, we also plan to reduce emissions by 50% by 2030 (compared to 2014). In addition, in the 2024 Medium-Term Business Plan, we have set a target to reduce emissions by 47% by FY2026 (versus 2014 levels).

- 5Scope 1 and 2 of the GHG Protocol, an international standard for the accounting and reporting of greenhouse gas (GHG) emissions.

The second target is to achieve net zero CO2 emissions across the entire value chain by 2040. As an interim target, we also plan to reduce emissions by 50% by 2030 (compared to 2019). This is primarily based on our customers reducing CO2 emissions (Scope 3 (see Note 6)), through the use of our Group's products, as well as reduction contributions from the widespread use of CCUS.

- 6Scopes 3 of the GHG Protocol, an international standard for the accounting and reporting of greenhouse gas (GHG) emissions.

(2) Progress

As a result of the success of earlier energy conservation efforts, CO2 emissions for FY2023 were approximately 534,000 ton-CO2, a 44% reduction (compared to 2014), compared to the interim target of reducing Scope1 and 2 CO2 emissions by 50% by 2030.

For Scope3 emissions, a variety of development efforts are underway to meet the interim target of 50% reduction in 2030. Emissions in FY2023 were approximately 850 million tons, a reduction of 38%, showing steady progress towards achieving our target.

It should be noted that Scope 3 has a total of 15 categories, and in terms of our Scope 3 emissions, around 99% of CO2 emissions are from product use (Category 11), for which our primary countermeasure is reduction of such emissions. Going forward, we will consider more precise measuring methods and emission reduction in other categories as well.

(3) Roadmap for Target Achievement

The year 2030 marks the midpoint of our carbon neutrality target for 2040, and we continue to pursue various solutions to meet the target. From FY2021 to 2030, we will allocate a total of 2 trillion yen for carbon-neutral R&D and investments.

MHI will also promote energy conservation, streamlining, and electrification at its owned plants. At Mihara Machinery Works, which is positioned as a pilot plant for achieving carbon neutrality, we have installed a 12MW solar power generation facility that can de-fossilize all electricity demand at the plant, and have been utilizing the Works as a proving ground for our decarbonizing technologies and solutions. The CO2 emissions from the Works are expected to be reduced by 97.7% (compared to FY2021) from the efforts made through FY2023, including the installation of solar panels, energy conservation, and streamlining. Furthermore, we were able to acquire practical plant decarbonization know-how. The expertise and achievements obtained at the Works will be shared with the Group's domestic and overseas facilities.

In terms of technology development, MHI is working to expand its CO2 capture lineup. In addition to large-scale plants, for which MHI has an extensive record of achievements, we have commercialized small and medium-sized facilities with a recovery capacity of 0.3 to 200 tons/day, and have already delivered units to several customers. To further implement this technology in society, we will expand our partnerships with key players in the CCUS value chain. Regarding nuclear power, we are developing the Advanced Light Water Reactor "SRZ-1200" in collaboration with electric power companies, aiming for commercialization in the mid-2030s. In addition, in fiscal 2023, MHI was selected as the core company for design and development of a demonstration fast reactor and an HTGR (high-temperature gas-cooled reactor) demonstration reactor, both promoted by the Japanese government.

In addition, to build a hydrogen ecosystem, MHI has added hydrogen production and storage facilities to the existing demonstration power generation facilities at its Takasago Machinery Works, and begun full-scale operation of Takasago Hydrogen Park. In November 2023, we conducted a successful demonstration operation of 30% hydrogen fuel co-firing at the GTCC demonstration power plant in the Takasago Hydrogen Park, using a state-of-the-art JAC gas turbine (Note 7). The hydrogen used in the test was produced at facilities in Takasago Hydrogen Park. In addition, we have started a 100% hydrogen-firing demonstration using a small- to mid-sized H-25 gas turbine installed in the park. For JAC gas turbines, we will proceed with the expansion of the hydrogen storage facility and other preparations for demonstration operation using 50% hydrogen mixed fuel.

- 7The hydrogen mixture ratio is expressed as a volume ratio.

MHI also began operation of the Nagasaki Carbon Neutral Park in FY2023 as a base for development of the Group's energy decarbonization technologies. With the aim of furthering the use of hydrogen, biomass, and ammonia, we are pursuing development of fuel production and combustion technologies, as well as CO2 capture technology. In the area of hydrogen production, in addition to the development of advanced water electrolyzers that operate by solid oxide electrolysis cells (SOEC), we will pursue research and development on next-generation hydrogen production technologies such as pyrolysis of methane into hydrogen and solid carbon (turquoise hydrogen). After developing key technologies at the Nagasaki Carbon Neutral Park, we plan to conduct a hydrogen production demonstration operation at Takasago Hydrogen Park, and a power generation demonstration in combination with a hydrogen gas turbine.