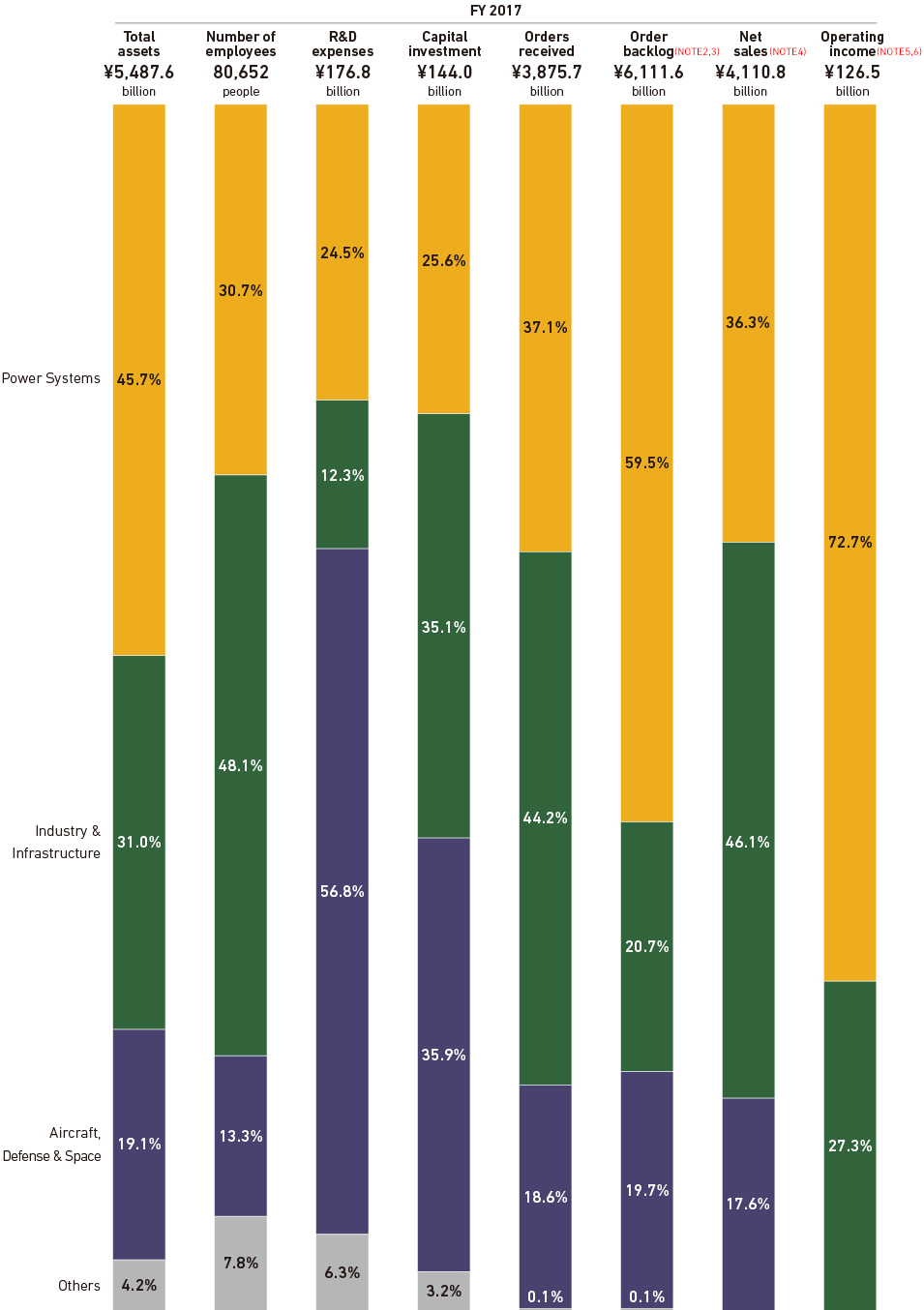

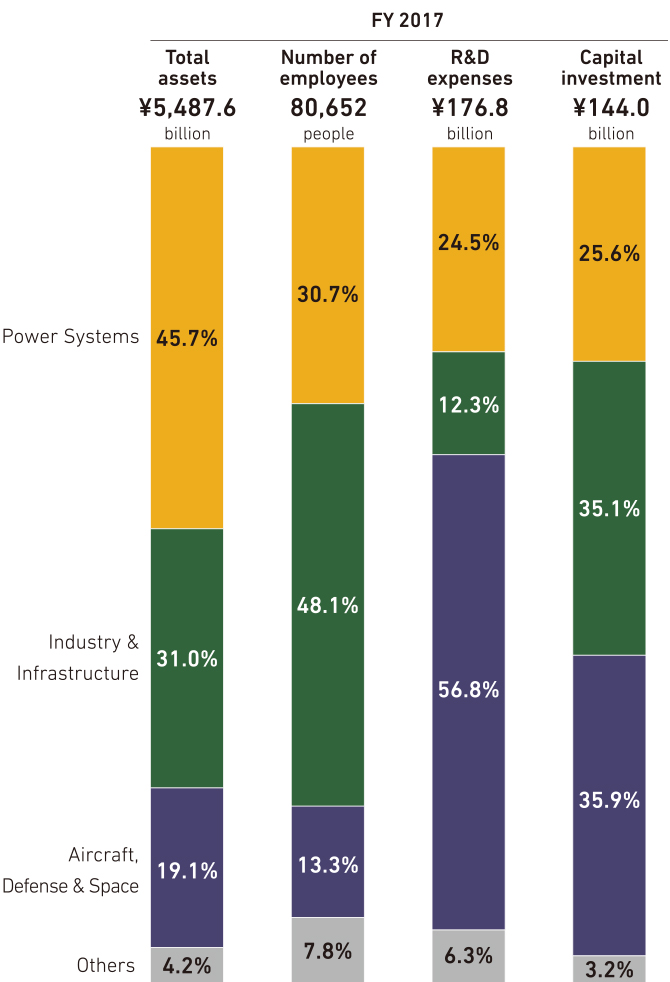

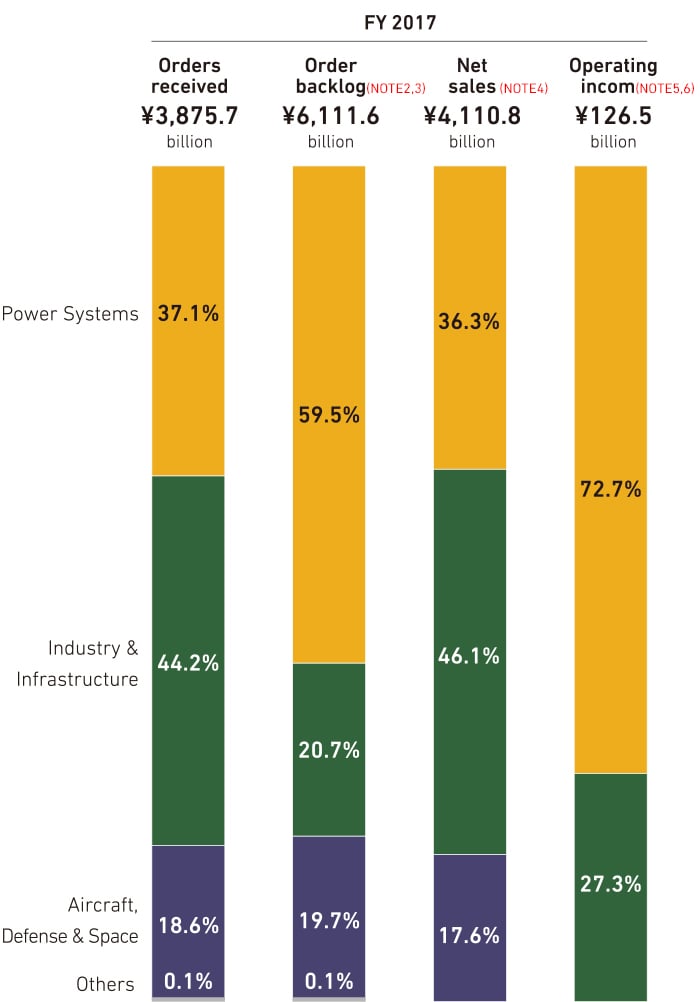

BUSINESS SEGMENT HIGHLIGHTS

Power Systems

Having been hit by global market factors such as the acceleration of the shift to low-carbon approaches and the switch to renewable energy, coal-fired power plants saw a significant decline, and order volumes for gas turbine combined cycle (GTCC) systems also fell considerably. As a result, consolidated orders received decreased year on year, to ¥1,437.5 billion. Consolidated net sales rose year on year to ¥1,493.9 billion, driven by steady progress in work related to orders for gas and steam power generations, as well as increases in aero engines.

Although there were improvements in the profitability of the gas and steam power generations after-sales service, due to such factors as the decline in nuclear power plant equipment, operating income was flat year on year at ¥108.9 billion.

Industry & Infrastructure

Aircraft, Defense & Space

(NOTE1)ITS: Intelligent Transport Systems

(NOTE2)Mass and medium lot manufacturing, such as turbochargers and air conditioners, is not included

(NOTE3)Order backlog totals from close of fiscal 2017 onward do not include past orders for MRJ

(NOTE4)Others, eliminations or corporate …¥–5.1 billion

(NOTE5)Aircraft, Defense & Space …¥–15.1 billion

(NOTE6)Others, eliminations or corporate …¥–8.1 billion