CORPORATE GOVERNANCE

We are taking all stakeholders into consideration and working to enhance corporate governance on an ongoing basis.

Basic Approach

As a company responsible for developing the infrastructure that forms the foundation of society, MHI's basic policy is to execute management in consideration of all stakeholders and strive to enhance corporate governance on an ongoing basis in pursuit of sustained growth of MHI Group and improvement of its corporate value in the medium and long terms. In accordance with this basic policy, MHI endeavors to improve its management system, such as by enhancing its management oversight function through the separation of management oversight and execution and the inclusion of outside directors, and develop global management, focusing on the improvement of the soundness and transparency of its management as well as on diversity and harmony.

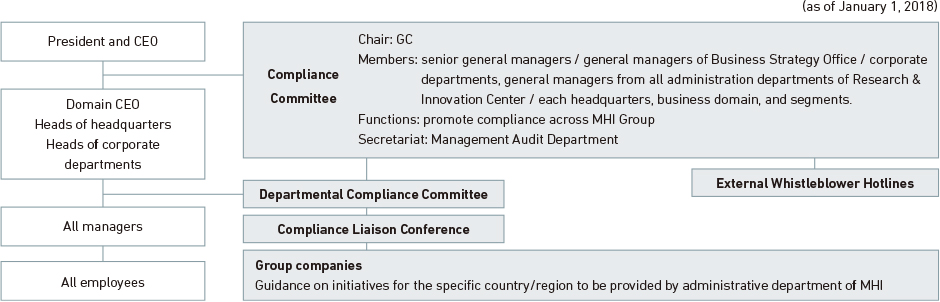

(NOTE) GC: General Counsel

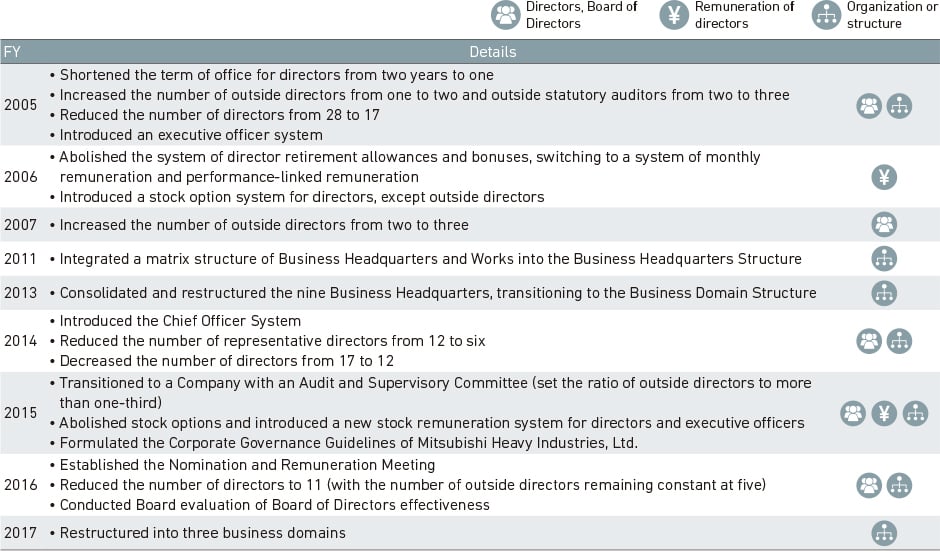

Recent Corporate Governance Reforms

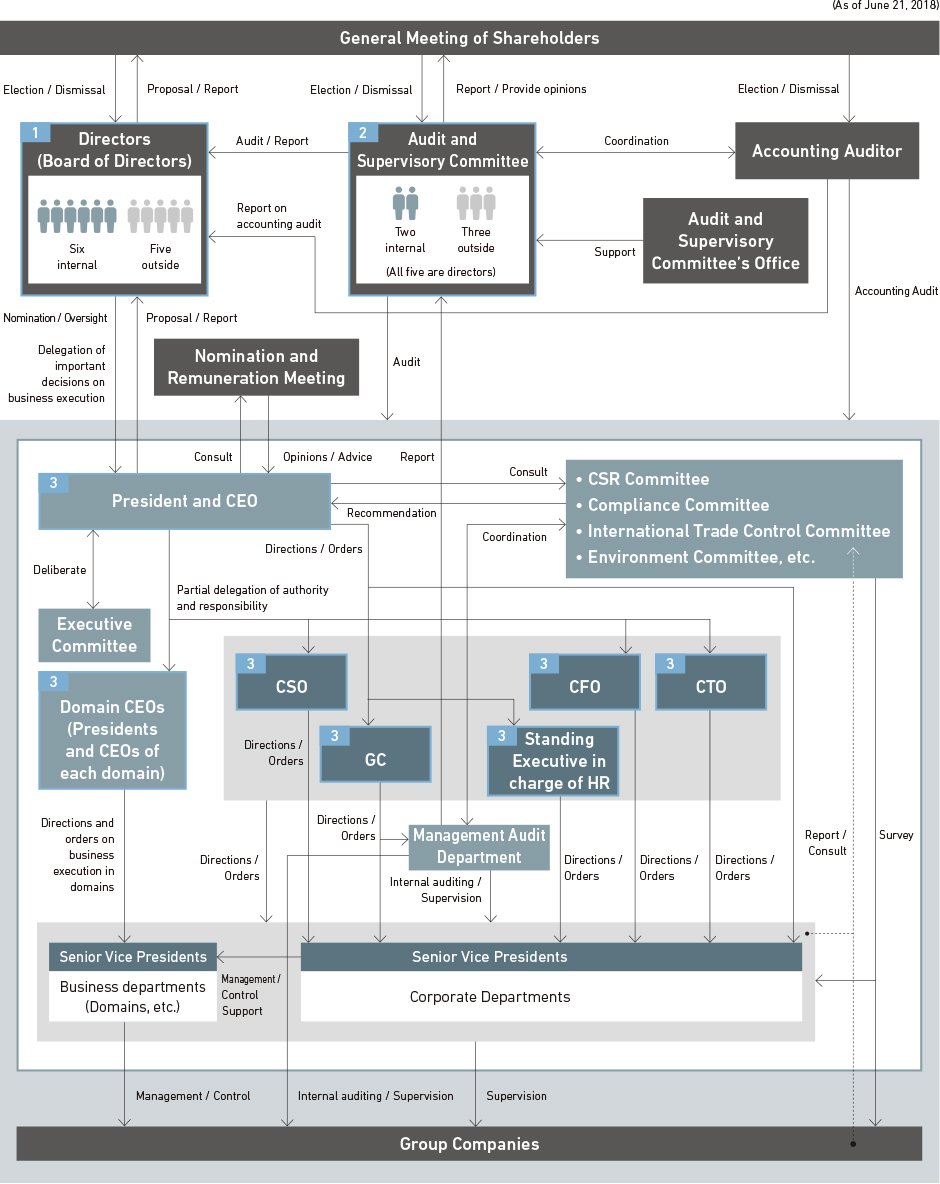

Corporate Governance Structure and Roles (Including Internal Control Systems)

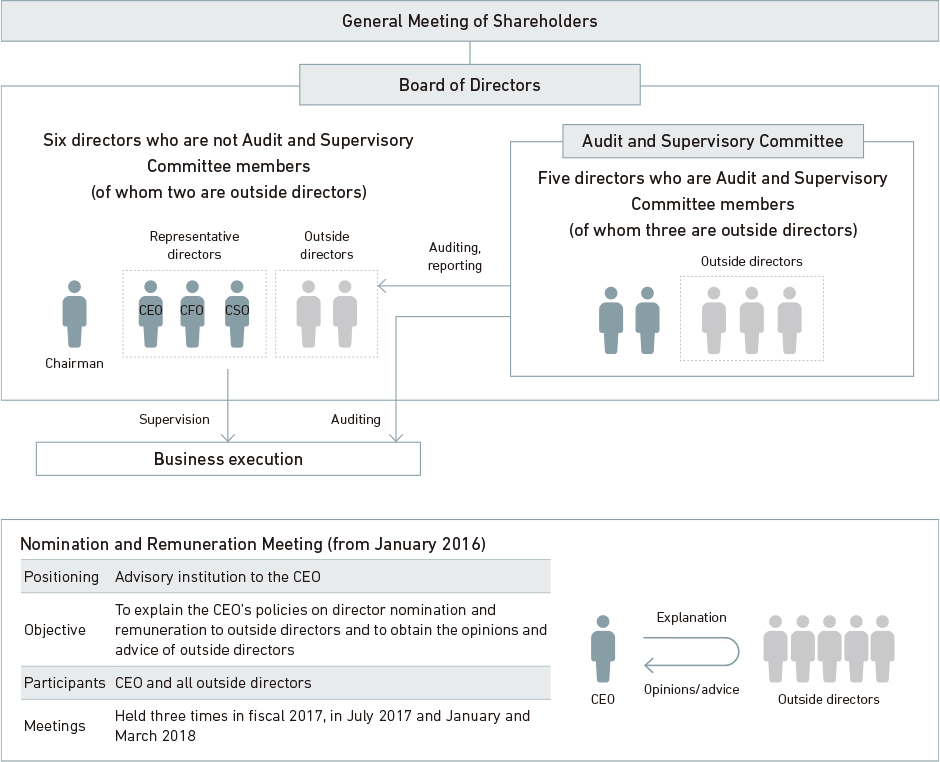

MHI has adopted the form of a Company with an Audit and Supervisory Committee as its corporate structure under the Companies Act. Our corporate governance structure, which includes internal control systems, is as follows.

Directors (Board of Directors)

Of the Company's 11 directors (of whom five are Audit and Supervisory Committee members), five (of whom three are Audit and Supervisory Committee members) are elected from outside the Company. In addition, in accordance with a resolution by the Board of Directors based on the Company's Articles of Incorporation, the Company delegates decisions on the execution of important operations to the president and CEO. This approach enables swifter decision making and enhances the flexibility of business execution while also strengthening the Board of Directors' oversight of business execution.

Audit and Supervisory Committee

To ensure the effectiveness of the Audit and Supervisory Committee's activities, the Company's Articles of Incorporation stipulate the selection of full-time members of the Audit and Supervisory Committee. Accordingly, two full-time members of the Audit and Supervisory Committee are mutually selected by the committee's members.

The full-time members of the Audit and Supervisory Committee attend meetings of the Executive Committee and other key meetings related to business planning, enabling them to accurately assess and monitor the status of management in a timely manner. As part of the audit, Audit and Supervisory Committee members make sure the execution of directors' duties complies with laws and regulations and the Articles of Incorporation and ascertain whether or not business operations of the Company are being executed appropriately by conducting spot checks and verifying compliance with relevant laws and regulations, and by monitoring the status of the establishment and operation of internal control systems, including those in relation to financial reporting.

The Audit and Supervisory Committee periodically exchanges information and opinions with the Management Audit Department and accounting auditors, and it collaborates closely with them in other ways, including receiving audit results and attending accounting audits. Audit and Supervisory Committee members also receive reports from the internal control department and other departments concerning the status of compliance, risk management, and other activities on both a regular and an individual basis. To support auditing activities, an Audit and Supervisory Committee's Office has been set up with its own dedicated staff of five to facilitate the work carried out by the Audit and Supervisory Committee.

Chief Officers and Standing Executives in Charge of Operations

The CEO(NOTE1) takes charge of overall business operations, and the domain CEOs take control of executing businesses within their individual domains based on overall Group strategies. The CSO(NOTE2) is in charge of the planning of all business strategies and the CFO(NOTE3) takes charge of finance, accounting, and management planning. The CTO(NOTE4) is in charge of the supervision and execution of overall operations related to technology strategies, research and development of products and new technologies, ICT, value chain, marketing, innovation, and engineering in general. In addition, the CSO, CFO, and CTO have Companywide authority to give instructions and commands and provide support to business domains. The GC and standing executive in charge of HR(NOTE5) assist the CEO with his duties by supervising and executing activities in line with the CEO's mission. The GC takes overall control of management audits, general administration, legal affairs, and global base support. The standing executive in charge of HR takes overall responsibility for human resources and labor relations.

(NOTE1) CEO:Chief Executive Officer

(NOTE2) CSO:Chief Strategy Officer

(NOTE3) CFO:Chief Financial Officer

(NOTE4) CTO:Chief Technology Officer

(NOTE5) HR:Human Resources

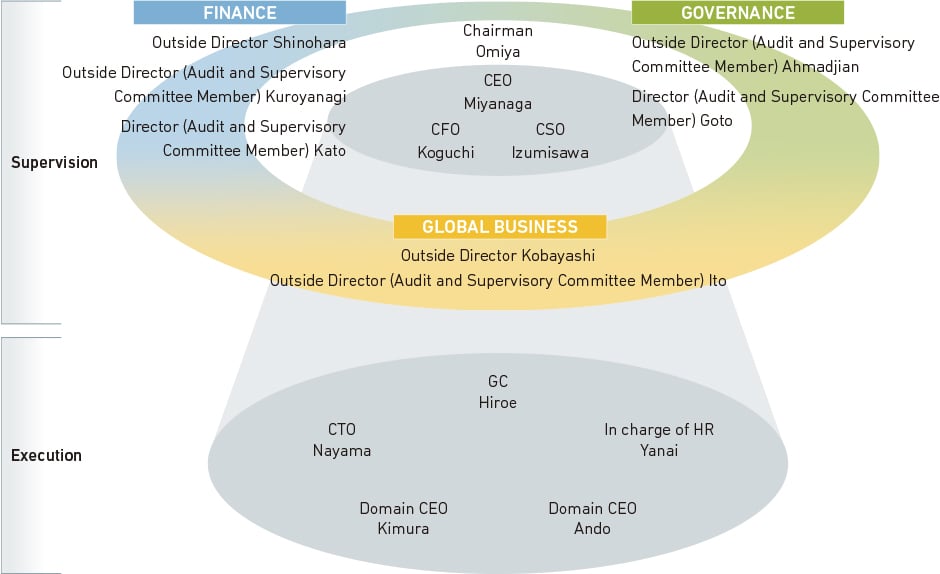

Board of Directors Structure (Supervision and Execution)

The Board of Directors comprises members with a variety of backgrounds, ensuring a balanced structure with which to supervise people handling business execution.

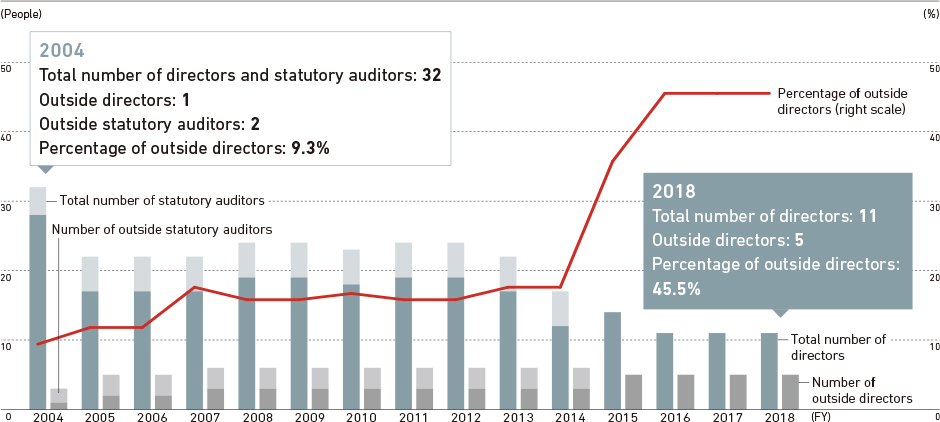

Changes in the Number of Directors and Statutory Auditors and the Percentage of Outside Directors

Outside Directors

The Company has five outside directors (of whom three are Audit and Supervisory Committee members). Outside directors are expected to enhance the soundness and transparency of the Company's management decision-making by providing beneficial views and candid assessments on the Company's management from an objective standpoint that is not biased by an internal company perspective. These individuals have diverse experience, knowledge, and skills in such areas as corporate management, public finance, and corporate governance.

Each of the outside directors meets MHI's independence criteria for outside directors.(NOTE) Accordingly, the Company judges all outside directors to be independent from its management team and has reported them as independent directors to the Tokyo Stock Exchange and other financial instruments exchanges in Japan.

All the outside directors are independent from management and supervise or audit management. At meetings of the Board of Directors, they receive reports on the status of the establishment and operation of internal control systems, including compliance, risk management, and other activities, and the results of internal audits, and they state their opinions when appropriate. The Audit and Supervisory Committee, a majority of whose members are outside directors, also conducts audits in collaboration with the Internal Audit Department, Management Audit Department, and accounting auditor. In addition, the Audit and Supervisory Committee shares information about the status of audits with outside directors who are not serving as Audit and Supervisory Committee members.

Board Evaluation

MHI took the enactment of Japan's Corporate Governance Code as an opportunity to analyze and evaluate the effectiveness each year of the overall Board of Directors. We seek to increase the effectiveness of the Board of Directors and ensure it is substantially fulfilling its duty of accountability to shareholders by verifying the overall effectiveness and role of the Board of Directors.

Based on a questionnaire of all directors, Board of Directors discussions, and so on, the Board of Directors confirmed that it functioned effectively in fiscal 2017.

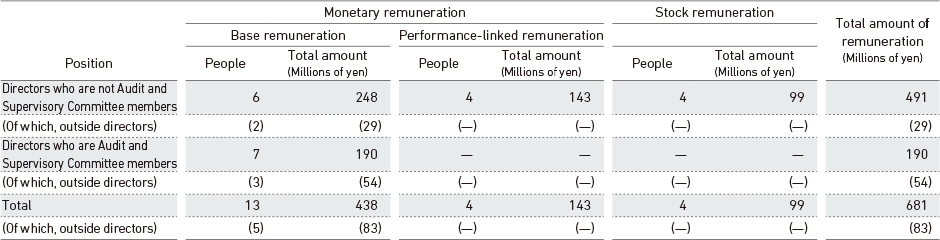

Officers' Remuneration Structure

The remuneration of directors (excluding Audit and Supervisory Committee members and outside directors) consists of base remuneration, performance-linked remuneration, and stock remuneration from the viewpoint of reflecting earnings and sharing values with shareholders.

Performance-linked remuneration is determined based on consolidated earnings while also taking into account the roles of each director and the business performance and accomplishments of the business of which he or she is in charge, etc.

For stock remuneration, the Board Incentive Plan Trust structure is used. MHI shares are issued, and remuneration is paid based on stock award points that are granted in accordance with return on equity (ROE) and other such indicators linked to MHI's medium/long-term earnings and stock price.

Remuneration of Directors

(NOTE) The recipients include two directors who were Audit and Supervisory Committee members who stepped down in fiscal 2017.

(NOTE) The maximum permitted monetary remuneration amount for directors who are not serving as Audit and Supervisory Committee members is ¥1,200 million per year (resolution of the 90th Ordinary General Meeting of Shareholders on June 26, 2015).

(NOTE) The total amount of stock remuneration is the amount of expenses recognized for the 234,000 stock award points granted in total during fiscal 2017 (equivalent to 23,400 shares of MHI) concerning the Board Incentive Plan Trust, which is a stock remuneration system that delivers or provides shares of MHI and money in the amount equivalent to the liquidation value of MHI shares based on stock award points granted to directors (excluding outside directors and directors who are serving as Audit and Supervisory Committee members) in accordance with, among other factors, the rank of the position of each director and the financial results of MHI. The maximum permitted amount of stock award points is 500,000 points (resolution of the 90th Ordinary General Meeting of Shareholders on June 26, 2015) per fiscal year for directors (excluding outside directors and directors who are serving as Audit and Supervisory Committee members).

(NOTE) The maximum permitted monetary remuneration amount is ¥300 million per fiscal year for directors who are serving as Audit and Supervisory Committee members (resolution of the 90th Ordinary General Meeting of Shareholders on June 26, 2015).

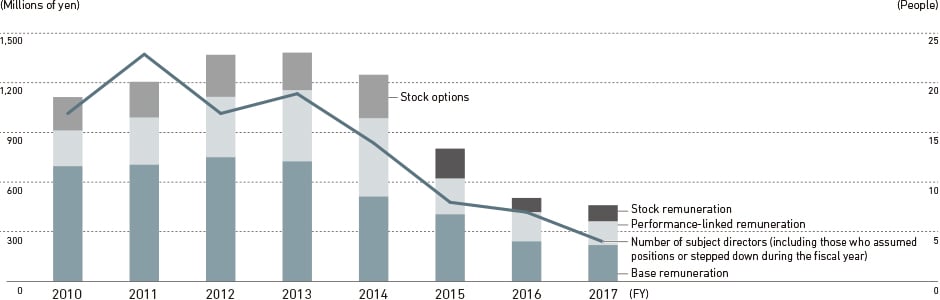

Remuneration of Directors(NOTE1)

(NOTE1) Remuneration of directors who are not Audit and Supervisory Committee members (excluding outside directors)

Nomination and Remuneration Meeting

The Nomination and Remuneration Meeting is composed solely of the five outside directors and the president and CEO. Prior to deliberation by the Board of Directors, this meeting serves as a forum for eliciting the opinions and advice of outside directors on the nomination of director candidates, the dismissal of directors, the appointment and dismissal of the CEO and other chief officers, and matters related to remuneration.(NOTE2) The aim of this meeting is to further augment transparency and fairness. In fiscal 2017, the Nomination and Remuneration Meeting met three times.

Taking into consideration the content of Japan's Corporate Governance Code (Revised Edition), we are considering measures to revise officer-related personnel and remuneration processes from the perspective of enhancing procedural objectivity and transparency.

(NOTE2) Excluding directors who are serving as Audit and Supervisory Committee members.

BUSINESS RISK MANAGEMENT

Throughout its history, MHI Group has achieved sustained growth by taking up diverse new challenges and initiatives in numerous business areas. At the same time, on occasion we have experienced losses on a large scale. In recent years especially, with the globalization of its business activities, the expanding scale of individual projects, and ongoing development of increasingly complex technologies, the scale of attendant risks is becoming larger than ever before.

In order for MHI Group to mark sustained growth amid an ever-changing business environment, it is necessary to continue to take up challenges in new fields, new technologies, new regions, and new customers as well as to improve and strengthen operations in its existing business markets. Such challenges will entail business risks, and a company's ability to curb risks wields significant influence on its business results and growth potentials.

To promote challenges of this kind and prepare for the next leap into the future, MHI Group, applying its past experience and lessons learned, aims to create the mechanisms that will ensure the effective execution of business risk management. At the same time, we reinforce advanced, intelligent systems and process monitoring, both of which support top management's strategy decisions. Through these approaches, we will pursue “controlled risk-taking” that will enable us to carry out carefully planned challenges toward expanding our business.

Outline of Business Risk Management

No corporation can avoid taking risks. We believe that risk management is a part of governance and functions only when the elements of systems and processes, corporate culture, and human resources are in place. For our Group to succeed in the global market, we need to take bold and daring risks, but we also need to manage those risks. That is the perfect combination for continually increasing our corporate value.

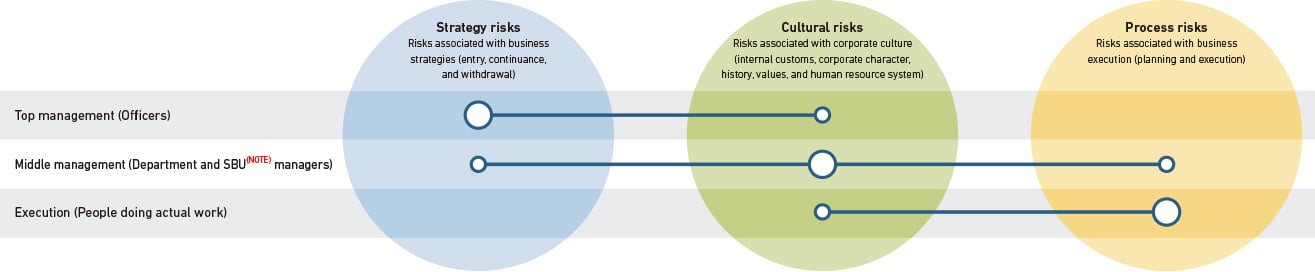

In this sense, it is very important that all business participants, from people engaged in the actual business to management, comprehend and control risks in business, from processes to strategies. For details, please see the chart below (Matrix of Business Risk Management).

Matrix of Business Risk Management

(NOTE) SBU: Strategic Business Unit

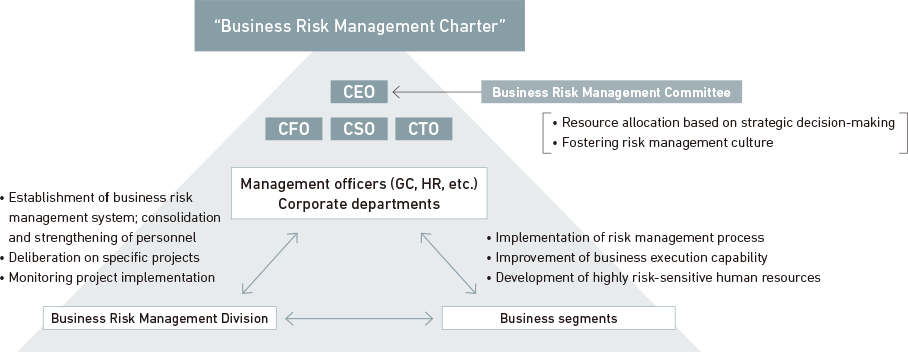

Business Risk Management Structure

Through the following measures, MHI Group is pursuing more organized business risk management and clarifying the roles of management, business segments, and corporate departments.

Observe and practice the Business Risk Management Charter as the Company's foremost set of rules

→ Clarify, observe, and practice risk management targets, etc.

Hold meetings of the Business Risk Management Committee, headed by the CEO

→ Share information on important risks and discuss policy response by top-level management

Content of Activities

With the Business Risk Management Department acting since April 2016 as the responsible department that reports directly to the CEO, MHI Group engages in business risk management activities bringing together management, business segments, and corporate departments.

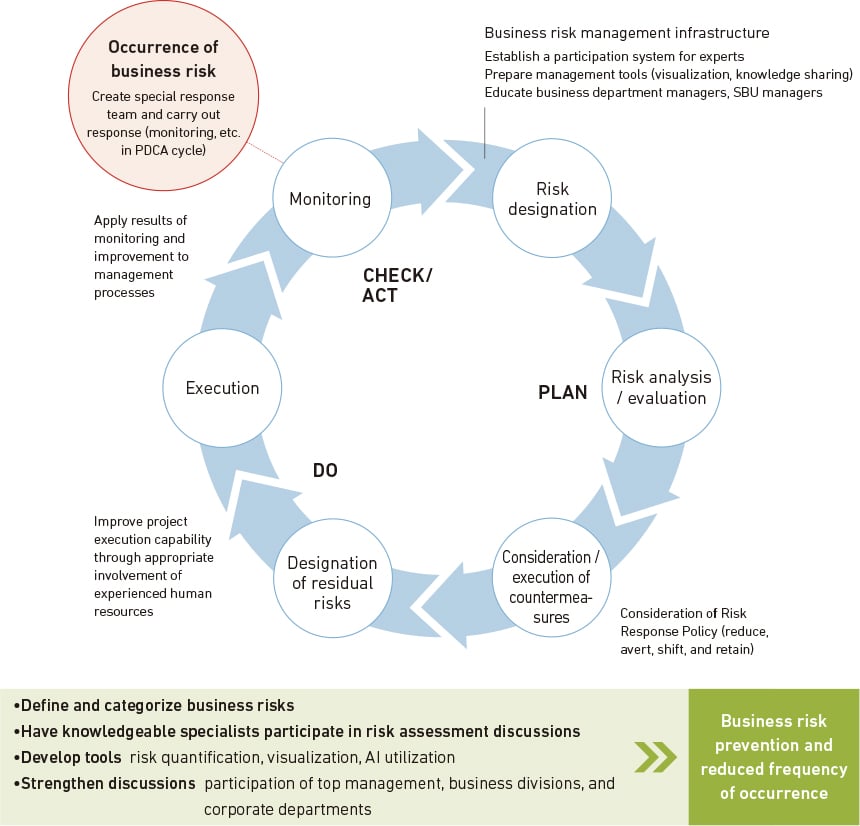

The chart below (Business Risk Management Process) outlines specific activities. In addition to improving systems and processes to prevent business risks and reduce the frequency with which such risks manifest themselves, we also develop human resources in charge of business risk management and cultivate a culture of responding to risks through training by the Group's management team.

Business Risk Management Process

COMPLIANCE

MHI Group attaches importance to complying with applicable laws and social norms and promoting fair and honest business practices. The Compliance Committee, established in May 2001, meets twice annually to draw up groupwide compliance promotion plans, confirm progress, and engage in other activities.

Since 2003, to increase awareness of compliance among individual employees, we have conducted discussion-based compliance training every year at the workplace level, themed on compliance cases that could arise on-site.

In May 2015, we issued the “MHI Group Global Code of Conduct.” As a global group, MHI Group employs thousands of individuals from different backgrounds, nationalities, and cultures. This diversity of talent and perspectives is one of our greatest assets. Having diverse backgrounds, it is important to work together and to promote our business under a common corporate culture.

This code of conduct sets out the basic principles and policies that all MHI employees should follow. We disseminate this code of conduct among MHI Group employees around the world through e-learning and by distributing booklets.

In order to ensure thorough compliance throughout MHI Group, we are conducting e-learning and study sessions for Group employees in Japan and overseas on anti-trust laws, anti-bribery, and export-related laws and regulations. In addition, we have created a compliance guidebook for employees engaging in technical and skilled jobs at MHI and Group companies in Japan, and we are promoting face-to-face education at each worksite to enhance compliance awareness.

In September 2017, we formulated the “MHI Compliance Global Policy,” clarifying basic matters related to compliance promotion, such as the organizational framework, roles, and administration standards that each Group company should follow. Along with the Global Code of Conduct, this policy clarifies our common code of conduct and basic rules that must be complied with throughout the Group. In this way, we are working to strengthen internal controls and enhance the level of compliance throughout the entire Group.

Number of participants at compliance training

Approximately 84,300 (FY2017)

Compliance Promotion System