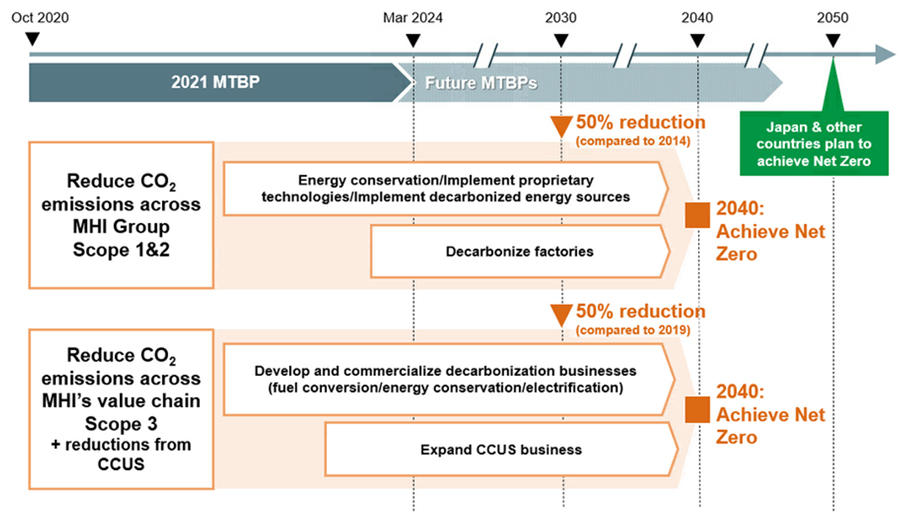

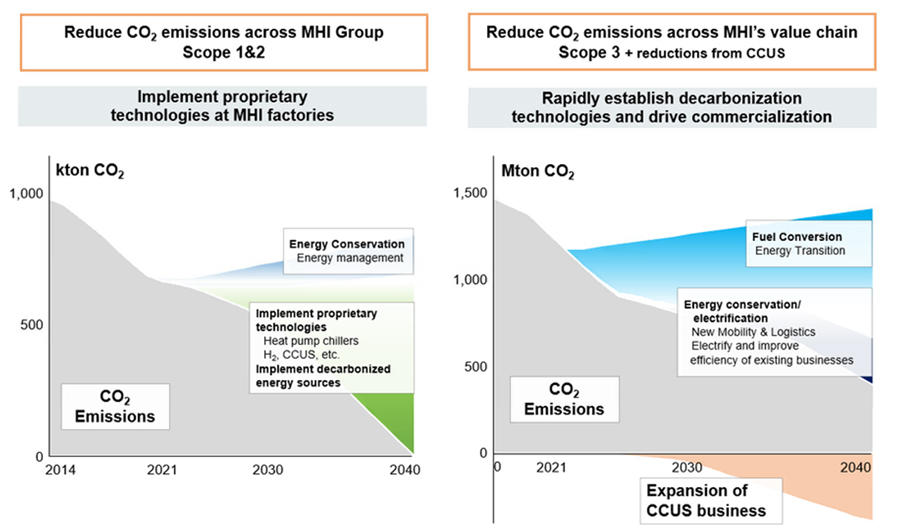

In accordance with the three statements that are at the heart of our Principles, MHI Group serves as a manufacturing corporation that contributes to societal progress through its business endeavors of delivering products and technologies in support of social and industrial infrastructure worldwide, and resolving global issues. MHI has defined two growth areas to focus on in its 2021 Medium-term Business Plan, announced in October 2020: "Energy Transition," which aims to decarbonize the energy supply side, and "Smart Infrastructure", which aims to realize the decarbonization, and promote the energy efficiency, manpower saving in the energy demand side. MHI Group is committed to promoting businesses of these two areas, and to advancing the decarbonization, electrification, and intelligence of the existing businesses, in order to achieve Net Zero by 2040. MHI Group made the declaration of achieving Carbon Neutrality by 2040 with the following newly set targets.

CO2 Emission Reduction Target

| Target Year | (1)Reduce CO2 emissions across MHI Group Scope1&2 Scope1,2 |

(2)Reduce CO2 emissions across MHI's value chain |

|---|---|---|

| 2030 | ▲50%(compared to 2014) | ▲50%(compared to 2019) |

| 2040 | Net Zero | Net Zero |

Scope 1&2: The calculation standard is based on the GHG Protocol

Scope 3: The calculation standard is based on the GHG Protocol. However, we also account for reductions achieved by CCUS as an MHI original index

CCUS: Carbon dioxide Capture, Utilization and Storage

Roadmap to Achieve Carbon Neutrality

The Record of Transition Bonds Issuance

| Bond name | Mitsubishi Heavy Industries, Ltd. 42nd Series Unsecured Bond (with inter-bond pari passu clause) (The 2nd Series of Mitsubishi Heavy Industries Transition Bonds) |

|---|---|

| Maturity | 5 years |

| Issuance amount | JPY 10 billion |

| Interest rate | 0.459% |

| Issue date | August 31, 2023 |

| Redemption date | August 31, 2028 |

| Use of proceeds | New investments and refinancing of existing investments relating to eligible businesses or projects (decarbonize existing infrastructure, build hydrogen solutions ecosystem, build a CO2 solutions ecosystem) |

| Acquired rating | AA- (Japan Credit Rating Agency, Ltd. [JCR]) |

| Lead managers | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Mizuho Securities Co., Ltd. Nomura Securities Co., Ltd. Daiwa Securities Co., Ltd. SMBC Nikko Securities Inc. BofA Securities Japan Co., Ltd. Goldman Sachs Japan Co., Ltd. |

| Second party opinion | DNV Business Assurance Japan K.K. |

| Evaluation of the transition bond's suitability | The Company has received a second party opinion (SPO) from DNV Business Assurance Japan K.K., a third-party institution, attesting to the transition bond's conformity with: ICMA Green Bond Principles 2021; Ministry of the Environment Japan Green Bond Guidelines 2020; LMA, APLMA and LSTA Green Loan Principles; Ministry of the Environment Japan Green Loan and Sustainability Linked Loan Guidelines 2020; ICMA Climate Transition Finance Handbook 2020; and Financial Services Agency, Japan + Ministry of Economy, Trade and Industry +Ministry of the Environment Japan Basic Guidelines on Climate Transition Finance (May 2021). |

News dated August 25, 2023

News dated July 28, 2023

| Bond name | Mitsubishi Heavy Industries, Ltd. 40th Series Unsecured Bond (with inter-bond pari passu clause) (1st Mitsubishi Heavy Industries Transition Bond) |

|---|---|

| Maturity | 5 years |

| Issuance amount | JPY 10 billion |

| Interest rate | 0.310% |

| Issue date | September 8, 2022 |

| Redemption date | September 8, 2027 |

| Use of proceeds | New investments and refinancing of existing investments relating to eligible businesses or projects (decarbonize existing infrastructure, build hydrogen solutions ecosystem, build a CO2 solutions ecosystem) |

| Acquired rating | AA- (Japan Credit Rating Agency, Ltd. [JCR]) |

| Structuring agent | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. |

| Lead managers | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Mizuho Securities Co., Ltd. Nomura Securities Co., Ltd. Daiwa Securities Co., Ltd. BofA Securities Japan Co., Ltd. Goldman Sachs Japan Co., Ltd. |

| Second party opinion | DNV Business Assurance Japan K.K. |

| Evaluation of the transition bond's suitability | The Company has received a second party opinion (SPO) from DNV Business Assurance Japan K.K., a third-party institution, attesting to the transition bond's conformity with: ICMA Green Bond Principles 2021; Ministry of the Environment Japan Green Bond Guidelines 2020; LMA, APLMA and LSTA Green Loan Principles; Ministry of the Environment Japan Green Loan and Sustainability Linked Loan Guidelines 2020; ICMA Climate Transition Finance Handbook 2020; and Financial Services Agency, Japan + Ministry of Economy, Trade and Industry +Ministry of the Environment Japan Basic Guidelines on Climate Transition Finance (May 2021). |

| Reporting |

Green/Transition Finance Framework

MHI has developed "Mitsubishi Heavy Industries, Ltd. Green/Transition Finance Framework" and has obtained a second party opinion from DNV, an independent external reviewer, that this framework is aligned with the following principles and guidelines.

- ICMA Green Bond Principles 2021

- Ministry of the Environment Japan Green Bond Guidelines 2020

- LMA, APLMA, LSTA Green Loan Principles

- Ministry of the Environment Japan Green Loan and Sustainability Linked Loan Guidelines 2020

- ICMA Climate Transition Finance Handbook 2020

- Financial Services Agency, Japan; Ministry of Economy, Trade and Industry, Japan; and Ministry of the Environment Japan Basic Guidelines on Climate Transition Finance (May 2021)

- Mitsubishi Heavy Industries, Ltd. Green/Transition Finance Framework (2.57MB)

- Second Party Opinion (2.03MB)

News dated September 2, 2022

News dated March 18, 2022